Why Now Is Still a Great Time to Invest in L.A.’s South Bay Real Estate

Let’s be honest: No one loves higher interest rates. But waiting on the “perfect” rate might mean missing out on a good investment and the dream of ownership. Buying in South Bay can still be a smart move. Home prices keep rising, the lifestyle is unmatched, and real estate offers long-term benefits. Let’s look at why buying now might be better than waiting.

Manhattan Beach, CA

1. South Bay Real Estate Is Still Appreciating

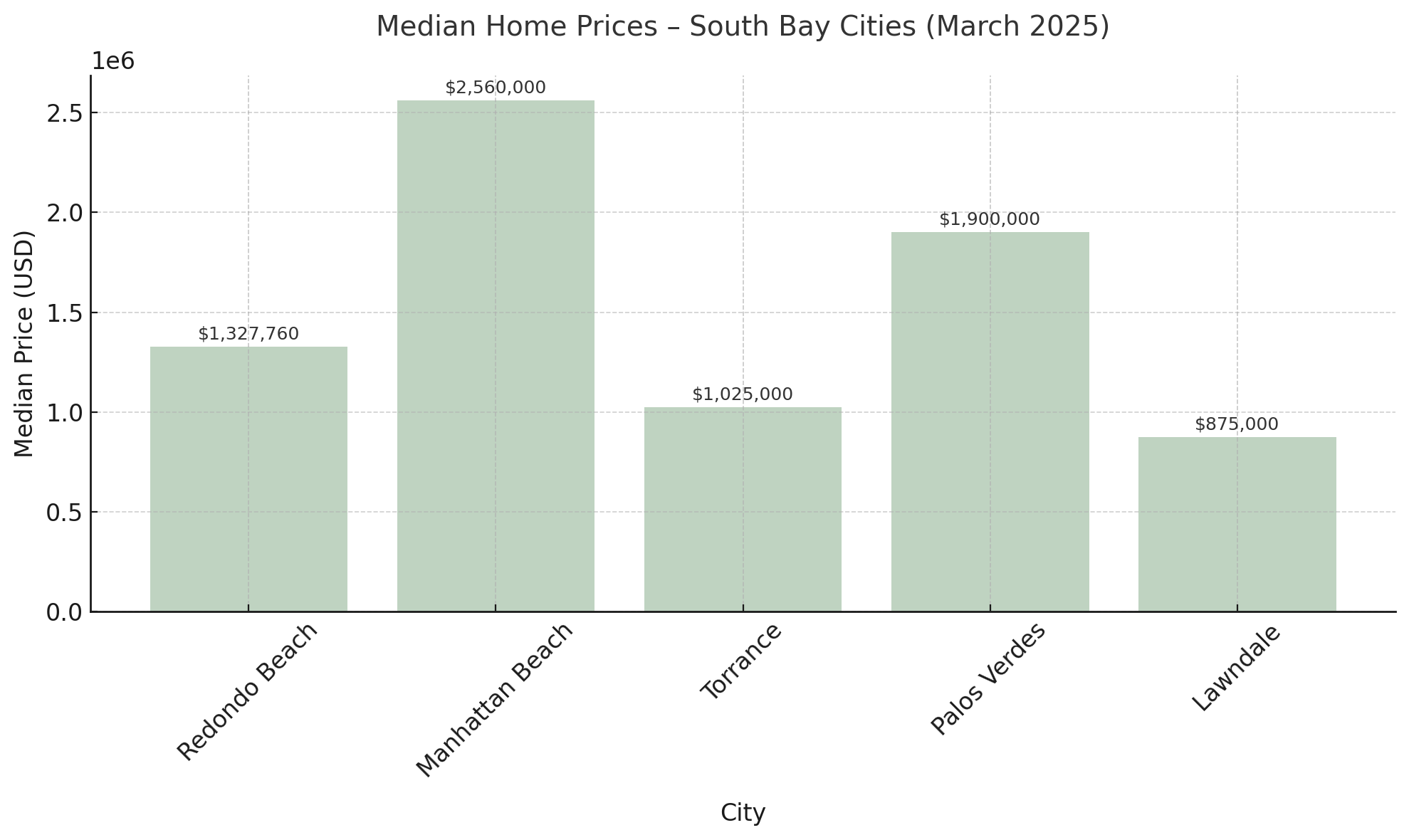

South Bay isn’t just a beautiful place to live – it’s a smart place to invest. From coastal cities like Manhattan Beach and Redondo to family-friendly Torrance or up-and-coming areas like Lawndale, home values have consistently shown strong long-term growth. Even with fluctuations, the trend in this region is upward.

• Inventory remains limited.

• Demand remains high, driven by lifestyle, good schools, and proximity to L.A. and the coast.

• Well-located homes continue to see multiple offers, especially when priced well.

Waiting for rates to drop may leave you paying more for the same home later.

In March 2025, the median sold price in South Bay topped $1.3M, marking a 6.4% increase year‑over‑year, even as other parts of Southern California saw only modest gains. Across the broader South Bay Cities (including Manhattan Beach, Torrance, Rancho Palos Verdes), the median surged to $1.8M, up 9.7% from February 2024.

South Bay home values continue to climb, and that long‑term appreciation can more than offset today’s higher borrowing costs.

The data shown reflects estimated median home prices as of March 2025 for select South Bay cities. Prices are subject to change based on market conditions, local inventory, and interest rates. This chart is intended for informational purposes only and should not be taken as financial advice. Sources: • California Association of Realtors (CAR) • CoreLogic Housing Market Report • California Regional Multiple Listing Service (CRMLS) • Internal research based on South Bay MLS data

2. Rates Aren’t Headlines-They’re Just Numbers

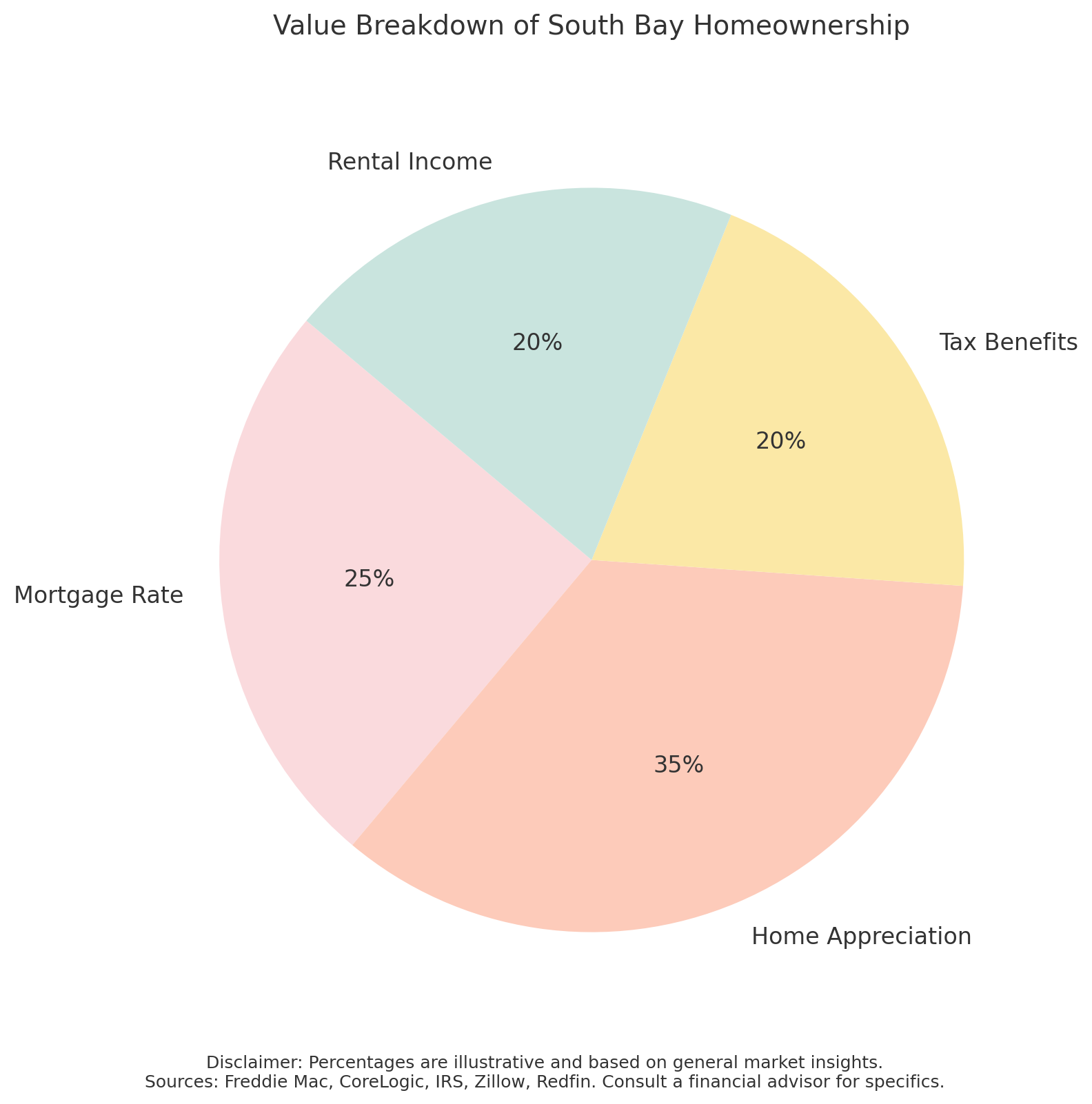

Yes, the average 30‑year fixed mortgage rate recently reached 6.81% (week ending April 11, 2025), its highest in two months. But national data from Freddie Mac pegs the same rate closer to 6.62%, down from 6.88% a year ago. In either scenario, locking in today’s rate protects you against future hikes, and you can always refinance later if rates drop. Yes, rates impact your monthly payment, but here’s what else matters:

• Home Appreciation: Your property is likely to gain value over time, building your wealth.

• Tax Benefits: Mortgage interest and property taxes may be deductible.

• Rental Income Potential: In the South Bay, rental demand is strong. If you’re investing, higher rates can often be offset by rental cash flow.

And I will say it again, a little truth most people forget:

You can refinance the rate.

You can’t rewind time and buy at yesterday’s price.

3. Real Estate Is a Hedge Against Inflation

When consumer prices rise, tangible assets like property often keep pace or even outstrip inflation. A fixed‑rate mortgage gives you predictable monthly payments, while the market value of your South Bay home is likely to continue climbing. Over the last decade, L.A. County housing prices have nearly doubled, despite inflation averaging 2-3% annually. Meanwhile, U.S. home‑price indexes have risen in lockstep with or ahead of CPI each year.

4. You Can’t Time the Market-But You Can Time Your Plan

Attempts to “wait for rates to drop” often backfire. Financial markets move unpredictably: last week’s rate retreat may reverse this week. History shows that missing even a few months of appreciation can cost more than a slightly higher rate. Experts agree that home‑price cycles last years, while rate cycles can be short‑lived. A long‑term hold (whether you live in the home or rent it out) lets you ride out both rate and price swings.

South Bay Homeownership

Beyond Dollars & Cents: Lifestyle and Security

• A desirable lifestyle market with long-term equity growth

• Tight supply that helps protect home values

• Strong buyer interest, even in a higher rate environment

All told, you gain more than shelter; you gain stability and peace of mind in uncertain times.

Final Thought: Buy for the Long Game

If you’re ready to explore opportunities in South Bay-whether as a homeowner or investor-let’s talk strategy. Even if your ideal rate hasn’t arrived, your ideal home may already be on the market.

Contact me today for a personalized South Bay market update.

Don’t let “rate regret” keep you from building equity. No one likes the fomo feeling!

Real estate is a long game, and South Bay is a strong board to play on.

If you’re planning to hold the property, live in it, or rent it for a few years or more, today’s rate isn’t a deal-breaker – it’s just a starting point. The equity you build, the appreciation you gain, and the stability you secure all outweigh the rate that may feel less than ideal right now.

The wonderful South Bay of L.A.

Sources: Business Insider, South Bay Housing Market Report March 2025, Reuters News, Lendingtree, AP News, FRED.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link