Senior Living in the South Bay: Finding the Right Fit for Every Stage

Senior Living in the South Bay: Finding the Right Fit for Every Stage

The South Bay offers more than ocean views and coastal charm. It’s also a place where older adults, retirees, and families explore new ways of living. Whether you’re looking for a senior community, deciding between renting or buying, or considering multigenerational living, there are options to match every lifestyle.

As a Seniors Real Estate Specialist® (SRES®), I guide clients through these important transitions with compassion, expertise, and a deep understanding of the South Bay market.

Finding a Senior Community That Fits Your Lifestyle

Many adults in their 60s and 70s hesitate at the thought of moving into a “senior” community. It’s normal to worry about losing independence or ending up in an environment that feels clinical.

But here’s the truth: today’s 55+ communities are evolving. Many offer resort-style amenities, social events, and walkable layouts. However, they still may not be the right fit for everyone.

My clients often want:

-

Homes with less maintenance but more personality.

-

Main-level living is designed with aging in place in mind.

-

Walkable, social neighborhoods with welcoming communities.

-

Space for pets, hobbies, and visiting grandkids.

These homes exist; you just need the right guidance to find them.

Should You Rent or Buy in Retirement?

Retirement brings new choices, including whether to rent or buy your next home. Renting can provide freedom, predictability, and access to amenities without the burden of maintenance. Buying, on the other hand, builds equity, stability, and long-term security.

Renting in Retirement

Pros:

Lower responsibility for upkeep.

Predictable monthly costs.

Freedom to travel and move easily.

Cons:

Rising rents and less long-term control.

Buying in Retirement

Pros:

Builds equity and security.

Ability to personalize and renovate.

May lower costs over time.

Cons:

Ongoing maintenance.

Less relocation flexibility.

As an SRES®, I help you compare these options with your personal goals in mind.

Loneliness and Connection in Later Life

Did you know loneliness is one of the biggest health risks as we age? More than one in three adults over 50 report feeling isolated. This can lead to depression, cognitive decline, and even increased health risks.

Connection matters. Small steps like joining a walking group, attending community events, or volunteering. It can make a real difference. Sometimes, moving to a more social neighborhood or closer to family opens new opportunities for engagement.

Choosing a home that encourages connection adds both years to your life and life to your years.

Multigenerational Homes: Growing Under One Roof

Multigenerational living is on the rise across the South Bay and beyond. Families are choosing homes that bring multiple generations together under one roof. Shared living can reduce expenses and create stronger bonds, but the right layout is essential.

Key features include:

-

Main-level suites for aging parents.

-

Separate entrances or private living spaces.

-

Accessibility features like no-step entries and walk-in showers.

-

Shared kitchens and dining areas built for connection.

-

Outdoor space for relaxation.

-

Ample storage to handle belongings from multiple households.

Every family has a different vision of what “home” looks like. As your South Bay SRES®, I help you find properties that balance comfort, independence, and togetherness.

About Me

I’m Malena Koki, a second-generation REALTOR® with over 16 years in the South Bay. As a Seniors Real Estate Specialist®, I specialize in guiding older adults, retirees, and families through transitions. From downsizing to finding pet-friendly senior communities to selecting multigenerational homes, I combine local expertise with genuine care.

Begin Your Next Chapter in the South Bay

Senior living doesn’t mean slowing down—it means living smarter. Whether you’re exploring senior communities, debating renting vs. buying, or considering multigenerational living, the South Bay has options designed for your next chapter.

Ready to find the right home for your lifestyle? Contact me today and let’s start the journey—on your terms.

🔗 Helpful Resources

Understanding Closing Costs in Redondo Beach: A Buyer and Seller’s Guide

Redondo Beach offers coastal living with unique costs to consider when buying or selling

When buying or selling a home in Redondo Beach, it’s easy to focus on price, location, and negotiations. However, one factor that often surprises both buyers and sellers is the closing cost. These are the expenses that finalize your real estate transaction, and understanding them is key to avoiding stress and planning wisely.

What Are Closing Costs?

Closing costs are the fees and expenses you pay at the end of a real estate transaction, on top of the purchase price (for buyers) or deducted from the sale proceeds (for sellers). They typically cover services like loan origination, escrow, title insurance, property taxes, and recording fees.

Closing costs cover the final steps of every Redondo Beach real estate transaction

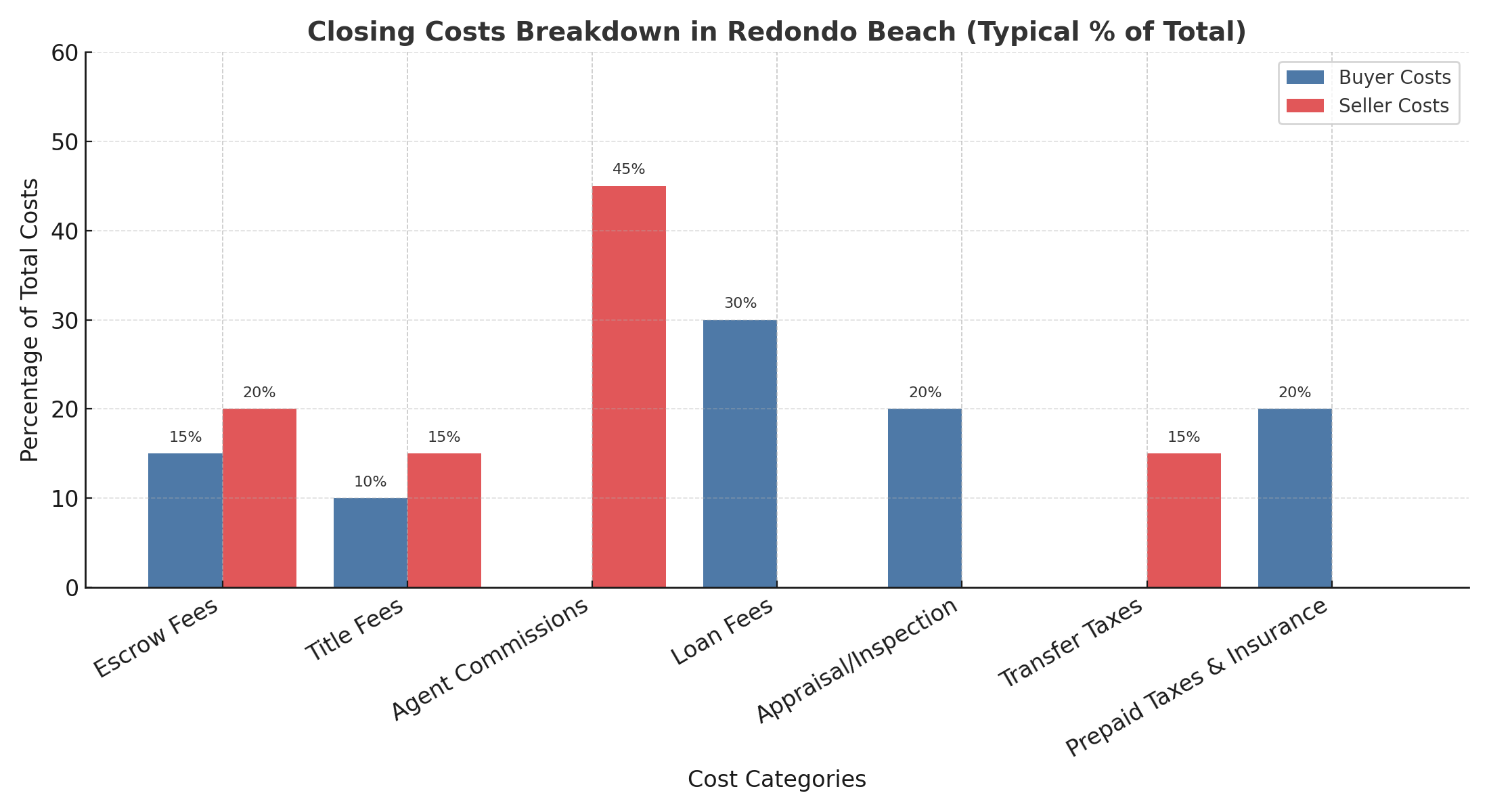

Typical Buyer Closing Costs in Redondo Beach

As a buyer, you can expect your closing costs to range between 2% and 5% of the home’s purchase price. For example, on a $1,000,000 Redondo Beach home, costs may be between $20,000 and $50,000.

Common Buyer Expenses:

-

Loan Origination Fees – Paid to your lender for processing your mortgage.

-

Appraisal and Inspection Fees – Covering professional assessments of the home.

-

Escrow Fees – Charged by the neutral third party who manages funds and paperwork.

-

Title Insurance – Protects against claims or disputes about property ownership.

-

Prepaid Taxes & Insurance – Property taxes and homeowner’s insurance are due at closing.

A young, happy couple is buying a new home and receiving the key from their real estate agent.

Typical Seller Closing Costs in Redondo Beach

Sellers usually pay more in closing costs, although many of these are tied directly to the sale proceeds. In Redondo Beach, sellers should budget around 6%–8% of the final sale price, with most of this being agent commissions.

Common Seller Expenses:

-

Agent Commissions – Typically 5%–6% of the sale price, split between the listing and buyer’s agents.

-

Escrow Fees – A portion of the escrow services cost.

-

Title Fees – Covering the transfer of title to the new owner.

-

Repairs or Credits – Negotiated with the buyer after inspections.

-

Transfer Taxes – Fees paid to the city or county for recording the transaction.

Sellers typically cover commissions, escrow fees, and title costs

Why Closing Costs Matter in Redondo Beach

Because Redondo Beach homes often sell in the $1M–$2M+ range, closing costs can be substantial. Buyers need to prepare cash reserves, while sellers should calculate net proceeds realistically. In competitive markets, sellers may even agree to cover some buyer costs to help finalize a deal.

Typical buyer vs. seller closing cost distribution in Redondo Beach real estate transactions

Tips to Prepare for Closing Costs

-

Ask for a Closing Disclosure Early – Buyers can review a detailed breakdown before signing.

-

Negotiate Smartly – In some cases, you can request a seller credit to offset costs.

-

Compare Lender Fees – Not all lenders charge the same origination or processing fees.

-

Work with a Local Expert – An experienced South Bay agent ensures no hidden surprises.

About Me: Your South Bay Real Estate Partner

I’m Malena Koki, a second-generation real estate agent with over 16 years of experience living and working in the South Bay. As part of Coldwell Banker Realty in Manhattan Beach, I’ve helped families, investors, and downsizers navigate the unique real estate opportunities that Redondo Beach offers.

Because I’ve lived in Los Angeles for more than 16 years with my husband, two children, and our three poodles, I understand both the lifestyle and financial aspects of buying or selling here. My background in investment property, global perspective from living in Japan and Europe, and concierge-level service allow me to guide clients seamlessly through every stage of their real estate journey.

Final Thoughts

Closing costs in Redondo Beach can feel overwhelming, but with the right preparation, they don’t have to be. Buyers should budget carefully, while sellers must calculate net proceeds to plan their next move. Because every transaction is unique, having an experienced local agent by your side can make all the difference.

✨ If you’re planning to buy or sell in Redondo Beach, I’d love to walk you through the process step by step. Contact me today for a personalized closing cost estimate tailored to your property.

🔗 Helpful Resources:

Is the Los Angeles Market Finally Easing? How South Bay Buyers Can Benefit in 2025

What Slower Single-Family Starts Mean for South Bay Real Estate in 2025

April’s report from the National Association of Home Builders (NAHB) reveals a mixed message. New construction is growing, but only in some segments. If you’re buying, selling, or investing in the South Bay or Greater Los Angeles, here’s what this means for you.

Multifamily builds rose, but single-family construction dropped

Housing starts rose 1.6% in April, reaching an annual rate of 1.361 million units. However, most of that growth came from multifamily housing, like apartment buildings and condos.

Meanwhile, single-family home starts fell 2.1%, dropping to 927,000 units. This matters because single-family homes remain the most desired option in suburban and coastal neighborhoods like Manhattan Beach, Redondo Beach, Hermosa Beach, and Palos Verdes.

Why the shift? Developers are focusing on higher-density options. This trend reflects affordability challenges, high land prices, and space limitations, especially in popular Southern California markets.

Building Permits Are Down—And That’s a Warning Sign

In April, building permits dropped 4.7%. This is important because permits are a forward-looking indicator. Fewer permits today mean fewer homes tomorrow.

This decline could lead to even tighter inventory in already competitive areas like the South Bay. If demand holds steady or increases, home prices could feel more upward pressure.

Other Market Pressures: Interest Rates, Fires, and Tariffs

The market isn’t just reacting to construction data. Several external factors are also creating uncertainty:

-

Interest rates remain elevated, keeping monthly payments high and affecting buyer affordability.

-

Recent wildfires across Southern California have disrupted construction timelines and increased insurance premiums.

-

Ongoing tariff concerns and supply chain issues could push construction costs even higher. That adds risk for builders and impacts future housing availability.

What to Expect Going Forward in South Bay Real Estate

1. Inventory Is Slowly Rising

-

We’re seeing an increase in homes for sale across South Bay cities like Manhattan Beach, Redondo Beach, Torrance, and Palos Verdes.

-

While inventory is still limited compared to pre-pandemic levels, this uptick gives buyers more choices.

2. Homes Are Taking Longer to Sell

-

Days on market are creeping up.

-

This shift is subtle but important—sellers may need to be more flexible, especially if their home isn’t priced right or move-in ready.

3. More Room for Negotiation

-

For buyers, this presents a unique window of opportunity.

-

You may be able to negotiate better terms, ask for repairs or credits, or even avoid bidding wars.

-

Pre-approval and a smart offer strategy still matter, but the dynamic is shifting slightly in your favor.

4. Prices Are Holding, But Momentum Is Easing

-

High interest rates continue to keep prices stable, but not surging.

-

The fear of missing out (FOMO) has cooled, and cautious buyers are starting to re-enter the market with more leverage.

5. Sellers Must Adjust Their Strategy

-

Proper pricing and strong presentation are more important than ever.

-

Homes that stand out—either through design, location, or value—will still move quickly.

-

Overpriced listings, however, may sit longer or require price reductions.

6. Still Watching: Interest Rates, Construction Costs, and Insurance

-

Higher borrowing costs and recent fires continue to affect timelines and buyer confidence.

-

Tariffs and global supply issues could push construction prices up again, making resale homes even more appealing in the near future.

Local Insight: South Bay Resale Market Still Strong

Even with higher borrowing costs, home prices in the South Bay remain resilient. Limited single-family supply is keeping values steady, especially in sought-after coastal communities.

Because there are fewer new homes, resale listings are more important than ever. That’s why I stay focused on uncovering off-market opportunities and prepping listings that shine.

Let’s Talk Strategy

The market is shifting. Whether you’re planning to buy, sell, or invest, it helps to have someone who understands how construction trends, economic factors, and local dynamics affect your next move.

📩 Ready to talk real estate in the South Bay or Greater Los Angeles? Let’s connect.

Sources: Single-Family Starts Down on Economic and Tariff Uncertainty (NAHB) , Building Permits by State and Metro Area (NAHB)

How volatile stock market and tariffs may affect the real estate market?

How Tariffs and a Wobbly Stock Market Could Shake Up Real Estate

Let’s talk about what everyone’s whispering (or panicking) about—tariffs, a rollercoaster stock market, and how all this could mess with (or maybe help?) the real estate market.

In early April 2025, the U.S. imposed some hefty new tariffs on imports from various countries. The goal? Support American industries. The result? Wall Street had a mini meltdown, and now everyone’s watching how this all might impact housing.

The Stock Market = Jumpy

Real Estate = Curious

The stock market didn’t take the news well. On April 3rd, the Dow dropped a jaw-dropping 1,679 points—the biggest single-day fall since 2020. Not to be left out, the S&P 500 and Nasdaq also tumbled. Investors, naturally, are nervous about where this all leads.

Meanwhile, the real estate world is standing by, saying, “Okay… how does this affect us?”

Let’s break it down:

1. Construction Costs Are Climbing

So, here’s the deal: New tariffs on imported building materials like steel, aluminum, and even lumber are shaking up construction costs across the country. But in Los Angeles, the impact hits a little harder.

Why? Because we’re already dealing with limited space, high demand, and some of the priciest building regulations in the country. Now add on an average $9,200 increase per new home (according to the National Association of Home Builders), and you’ve got a recipe for… well, even higher home prices.

That extra cost doesn’t just magically disappear. It usually gets passed on to the buyer. So, whether it’s a sleek new development in Downtown LA, a townhome in Culver City, or a modern build in the Valley, expect price tags to keep climbing.

And if you’re thinking, “Well, I’ll just wait for more homes to pop up,” here’s the kicker: Builders may actually slow down new projects because of these added costs. Less inventory + high demand = more competition (and more over-asking bids).

Building in L.A. Just Got Pricier, And That’s a Problem After the Fires

Many communities in and around LA, especially in areas like Malibu, Topanga, and parts of the Valley, are still in various stages of rebuilding. These tariff-driven price hikes are a major setback for homeowners trying to recover and for developers trying to rebuild responsibly.

The demand for fire-resilient construction is rising, but so are material prices. That makes it harder and more expensive to build. But what the market is looking for are homes that are safer, smarter, insurable, and up to code.

Less building, higher prices, and limited supply? Yep, that means more competition for existing homes and even steeper prices in new developments.

2. Real Estate as a Safe Haven?

Here’s the upside: When the stock market gets shaky, real estate starts to look like the calm in the storm. Investors are already shifting funds from stocks into homes.

There has been a resurgence in investment lending within the housing sector, with annual growth reaching its fastest pace since 2022. This trend suggests that residential property is becoming an attractive option for those seeking refuge from the unpredictable stock market.

Why? Bricks and mortar feel a lot more stable than stocks bouncing up and down like a bouncy house. In the long term, real estate always tends to be more stable than stocks.

3. Could Mortgage Rates Drop?

Yes, maybe! We can’t predict the future. But historically, when markets panic, investors flock to safer places like U.S. Treasury bonds. This increased demand can drive down yields, potentially resulting in lower mortgage rates. So, even with rising home prices, lower rates could help buyers afford more (or at least stay in the game). It’s like one hand gives while the other takes away.

Some experts believe that declining mortgage rates could enhance housing affordability, partially offsetting the impact of higher construction costs.

4. Commercial Real Estate? Feeling the Pinch.

The tariffs have raised concerns about a potential slowdown in international trade, which could affect demand for commercial properties, particularly warehouses and distribution centers. Warehouses and distribution centers might be in for a bumpy ride. If trade slows, companies won’t need as much storage space. Big names like Prologis are already seeing their stock slip. So, if you’re in the commercial space, it’s time to keep a close eye on global trade trends.

What About Buyers?

Tariffs could also lead to higher prices on everyday goods. When groceries, gas, and gadgets get more expensive, people naturally spend less. Especially on big-ticket items like homes. The National Retail Federation is already predicting a slowdown in consumer spending for 2025. Buyers may just hit “pause” until the dust settles.

So, will people still buy homes? Yes! But maybe more cautiously. Some will jump in to grab low mortgage rates. Others will wait out the storm. Either way, real estate isn’t crashing—but it’s definitely adjusting.

Impact on the Housing Market

The housing market is experiencing mixed signals amid these economic shifts. On one hand, mortgage rates have slightly declined due to market volatility, potentially making home loans more affordable. Additionally, housing inventory has increased, providing buyers with more options and potentially leading to more favorable pricing.

Conclusion

The implementation of broad tariffs by the U.S. government has introduced significant uncertainty into financial markets and the broader economy. While the real estate sector may experience both positive and negative effects, stakeholders should closely monitor ongoing developments. Potential increases in construction costs and shifts in investment strategies underscore the importance of staying informed and adaptable in this evolving landscape.

While certain factors, such as lower mortgage rates and increased housing inventory, may encourage home purchases, the overall economic uncertainty stemming from recent tariff implementations and stock market volatility is likely to make consumers more cautious. This caution could lead to a slowdown in major expenditures, including real estate transactions, as individuals await a more stable economic environment.

Bottom line: If you’re in the market (buying, selling, or investing), stay informed, stay flexible, and maybe stock up on popcorn. This show isn’t over yet.

Want help navigating the market in these wild times? Let’s chat—I’m happy to break it down with you.

Tax Season Is Coming—Let’s Keep More of Your Money!

Real Estate Investment

Let’s be real-no one enjoys tax season. Watching a big chunk of your hard-earned money disappear? Painful. But what if I told you real estate investing could help you legally pay less in taxes and build long-term wealth at the same time?

Yep, smart real estate investors know how to use tax benefits to their advantage, and you can too. Whether you own a rental property, are thinking about investing, or already have a growing portfolio, understanding these tax perks could mean more money in your pocket and less going to Uncle Sam. Be sure to always consult with your CPA before making any financial decisions. This information is for educational purposes only.

So grab a coffee (or a glass of wine 🍷-no judgment), and let’s break down four major tax benefits of real estate investing that could change your financial future.

1. Tax Deductions – AKA, Write-Off Heaven

When you own investment properties, a ton of expenses can be deducted from your taxable income, meaning you pay less in taxes.

Think about it: If you had to spend money on these things anyway, why not get a tax break for it?

What kind of things, you may wonder? Well, here are some examples:

-

-

Mortgage interest

-

Property taxes

-

Insurance

-

Maintenance & repairs

-

Property management fees

-

Legal & accounting costs and more!

-

Not too bad, right? Let’s continue reading (sipping too 😀 )

2. Depreciation – A Hidden Superpower for Investors

Real estate naturally loses value over time (at least on paper). The IRS lets you deduct that “loss” every year through depreciation. Even if your property is increasing in value.

📌 Residential properties depreciate over 27.5 years

📌 Commercial properties depreciate over 39 years

Let’s say you own a $500,000 rental property (not including land). Divide that by 27.5 years, and boom- $ 18,181 in annual deductions you can take, lowering your taxable income. That’s free tax savings for simply owning property!

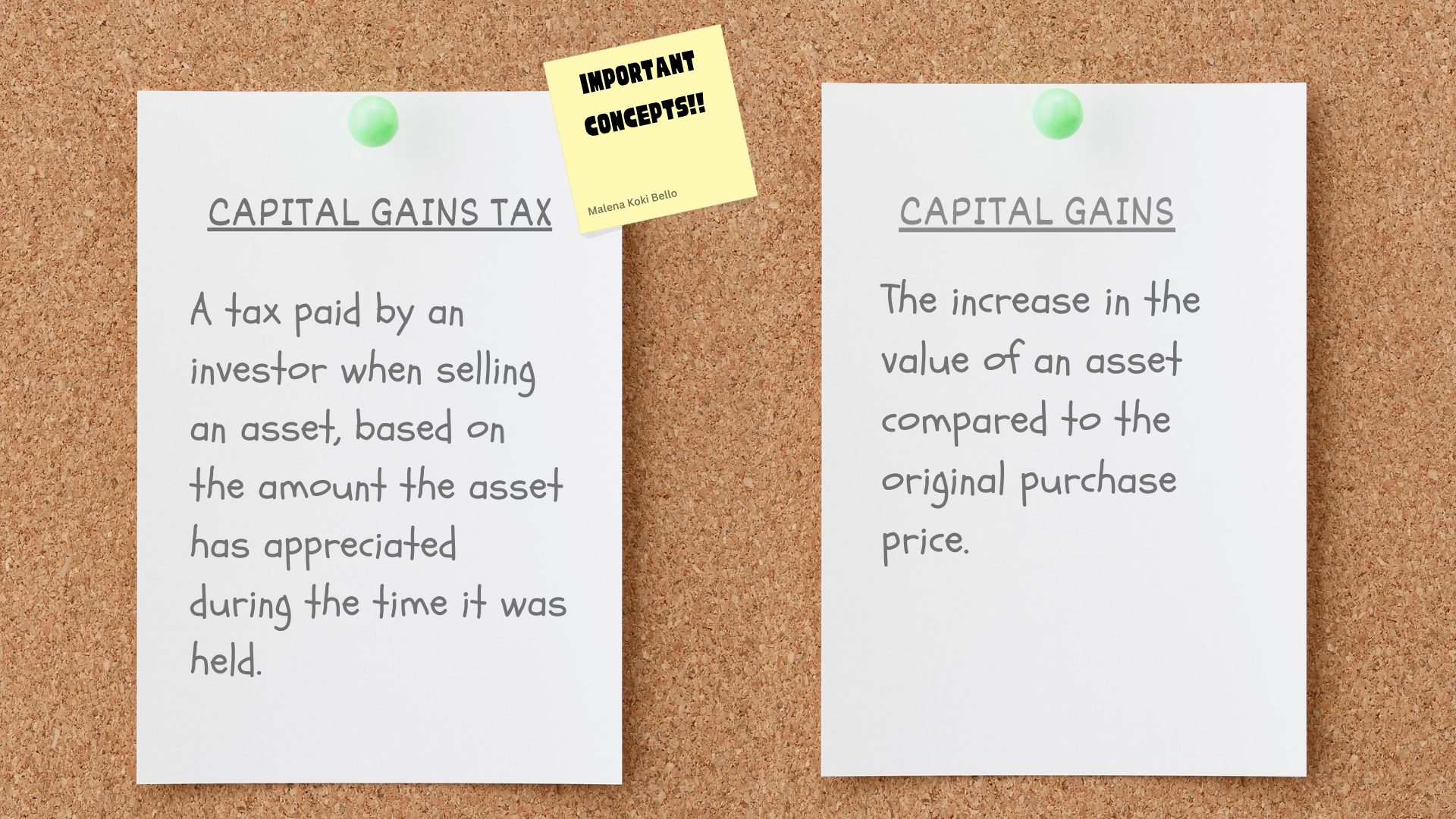

3. Capital Gains Tax – Play It Smart When You Sell

Selling real estate at a profit? Congrats! But before you celebrate, let’s talk about capital gains tax.

- Short-term capital gains (owning for less than a year) = higher taxes (treated like regular income).

- Long-term capital gains (owning for a year or more) = lower taxes (0%, 15%, or 20% tax rate).

Capital Gain vs Capital Gain Taxes

👉 Pro tip: Hold onto your property at least a year before selling. It could save you thousands in taxes!

4. The 1031 Exchange – The Ultimate Tax Hack

Want to sell a property but avoid paying capital gains taxes? The 1031 exchange lets you reinvest your profits into another property (of equal or greater value) and defer those taxes.

1031 Exchange

Translation: Keep upgrading your real estate portfolio without getting taxed on every sale. Use it enough times, and you could keep rolling your wealth forward tax-free for decades.

Use Your Tax Return Strategically

If you’re expecting a tax refund this year, consider using it as a stepping stone toward your real estate goals. Instead of spending it on short-term purchases, you could apply it toward a down payment, closing costs, or even invest in home improvements that increase your property’s value. This is also a great time to consult with your CPA and a real estate advisor to align your refund with your long-term financial strategy—whether you’re buying your first home, expanding your portfolio, or planning for retirement. Real estate can turn that refund into something that keeps paying you back over time.

If you want to learn how to maximize these tax benefits for yourself, let’s talk! I’d love to help you strategize and find the best real estate investment opportunities. I’m based in Manhattan Beach, CA, part of the beautiful South Bay.

📩 DM me or call me today, let’s make sure your money is working for YOU!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link