Living in South Bay, CA: A Lifestyle and Real Estate Guide

Living in South Bay, CA: A Lifestyle and Real Estate Guide

The South Bay coastline blends stunning beaches, oceanfront homes, and a vibrant community lifestyle

Living in the South Bay of Los Angeles means coastal beauty, vibrant communities, and a relaxed lifestyle. Nestled along the Pacific Ocean, the area blends ocean views, charming neighborhoods, and countless activities. Whether you’re a longtime resident or planning a move, understanding South Bay life helps you thrive.

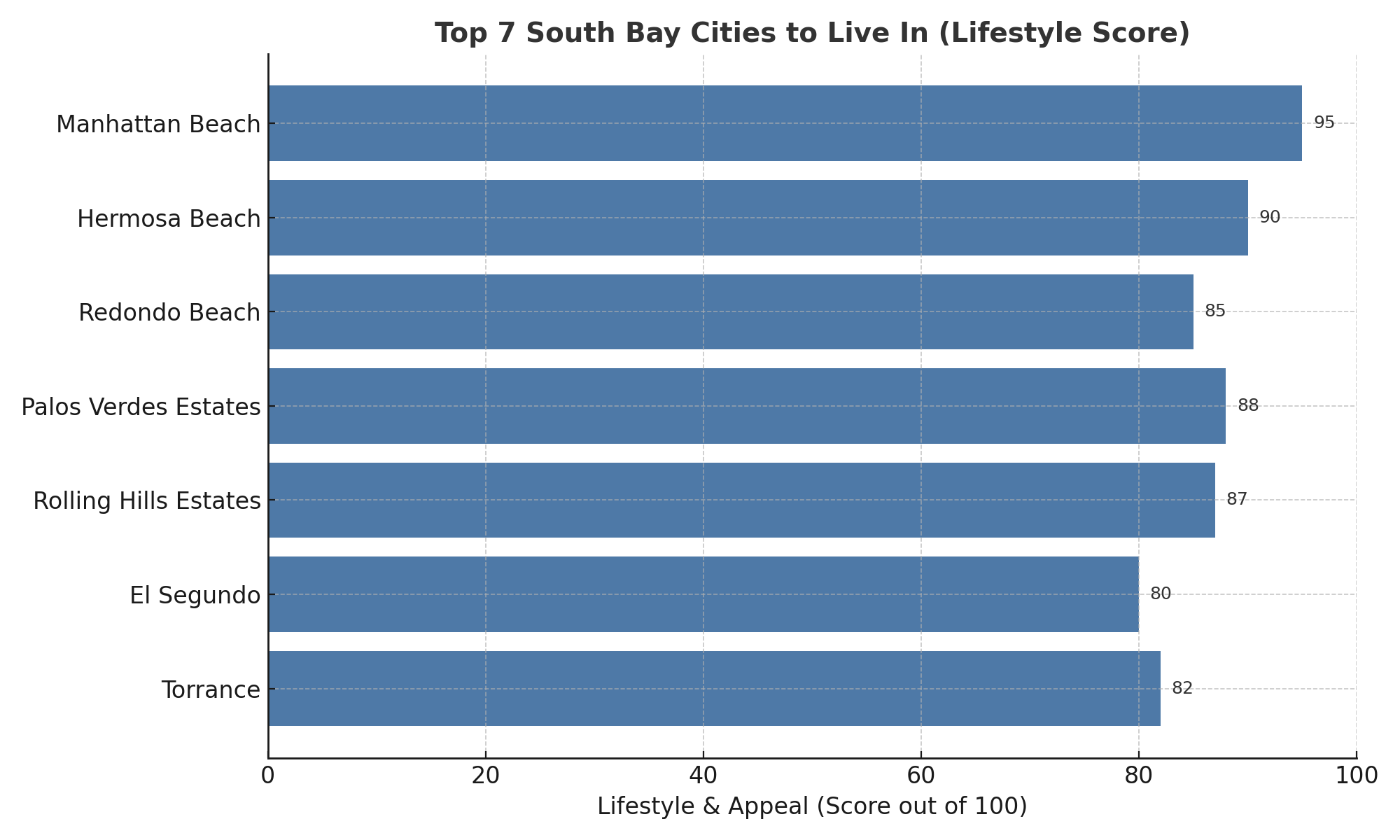

Lifestyle scores for the top 7 South Bay cities, from Manhattan Beach to Torrance

Exploring the Beaches

South Bay is famous for its beaches, each offering a unique charm and lifestyle.

-

Manhattan Beach blends luxury homes, The Strand, and world-class dining.

-

Hermosa Beach adds surf culture, live music, and a strong sense of community.

-

Redondo Beach combines family neighborhoods, a lively pier, and a popular marina.

Along the coast, The Strand invites biking, jogging, or strolling at sunset. Because dining options line the beach, ending your day oceanfront feels natural and easy.

South Bay beaches offer recreation, relaxation, and coastal beauty

Neighborhoods and Communities

The South Bay includes diverse communities, all with distinctive appeal.

-

Palos Verdes Estates offers privacy, cliffs, and equestrian estates.

-

Rolling Hills Estates blends suburban tranquility with open land and horse trails.

-

Torrance provides excellent schools, suburban comfort, and major shopping.

-

El Segundo mixes small-town charm with corporate hubs and commuter access.

Each city reflects a lifestyle choice. Choosing wisely connects your daily life to your priorities.

From luxury estates to family neighborhoods, the South Bay offers variety

Outdoor Recreation and Activities

South Bay living is active, healthy, and connected to nature.

-

The Palos Verdes Peninsula features hiking trails with breathtaking ocean views.

-

The South Bay Bicycle Trail stretches for miles, connecting beaches and towns.

-

Water sports like surfing, paddleboarding, and kayaking thrive year-round.

Because of mild weather, outdoor fun becomes part of everyday life, not just weekends.

Recreation thrives in South Bay, from trails to water sports

Dining and Culinary Scene

Food in the South Bay is as diverse as its people.

-

Upscale dining in Manhattan Beach satisfies foodies and investors alike.

-

Beachfront cafes in Hermosa capture casual, social energy.

-

Local favorites in Redondo Beach offer fresh seafood and coastal views.

Farmers’ markets across the region connect residents with fresh, local produce. Dining here means more than food—it’s community and culture.

Arts, Culture, and Shopping

South Bay balances small-town warmth with big-city amenities.

-

The Torrance Cultural Arts Center hosts concerts, exhibits, and workshops.

-

Local galleries highlight both established and emerging artists.

-

Festivals unite neighbors and celebrate the region’s rich heritage. Like Fiesta Hermosa in Hermosa Beach!

For shopping, Del Amo Fashion Center in Torrance is one of the largest malls in America. Boutique shopping in beach towns creates variety and charm.

Malena Koki at Fiesta Hermosa

Education and Opportunities

Education is a top reason families choose South Bay.

-

Palos Verdes Unified and Torrance Unified are consistently ranked among the best.

-

Private schools add additional options for families seeking specialized programs.

-

Local colleges and community centers provide lifelong learning opportunities.

Because schools connect directly to property values, real estate here remains strong.

Transportation and Access

South Bay is well-connected.

-

The Pacific Coast Highway and Interstate 405 ensure easy access.

-

Public buses and the Metro Rail connect neighborhoods to Los Angeles.

-

Extensive bike lanes make cycling safe and popular.

This accessibility strengthens the area’s appeal for commuters and investors alike.

Real Estate and Housing Market

The South Bay real estate market is dynamic and diverse.

-

Beachfront homes in Manhattan Beach and Hermosa carry premium values.

-

Redondo Beach condos and townhomes provide balance for growing families.

-

Palos Verdes Estates offers privacy, views, and equestrian opportunities.

Because the market is competitive, working with a knowledgeable agent is essential. Insight into micro-markets helps buyers and sellers succeed.

About Me

I’m Malena Koki, a second-generation REALTOR® based in Manhattan Beach. With over 16 years in the South Bay, I live here with my husband, two kids, and three poodles. My background in investment property, global perspective, and concierge-level service help clients achieve both lifestyle and financial goals.

Whether it’s Redondo Beach family homes, Palos Verdes estates, or Manhattan Beach luxury, I bring local expertise and personalized care.

Discover Your New Home in South Bay

South Bay, CA, offers beaches, schools, culture, and community—a lifestyle unmatched in Los Angeles. Whether you crave the energy of Hermosa, the luxury of Manhattan Beach, or the tranquility of Palos Verdes, the right home is here.

Ready to explore? Contact me today for a private consultation. Let’s make your South Bay dream home a reality.

Helpful Resources for Buyers and Sellers

Senior Living in the South Bay: Finding the Right Fit for Every Stage

Senior Living in the South Bay: Finding the Right Fit for Every Stage

The South Bay offers more than ocean views and coastal charm. It’s also a place where older adults, retirees, and families explore new ways of living. Whether you’re looking for a senior community, deciding between renting or buying, or considering multigenerational living, there are options to match every lifestyle.

As a Seniors Real Estate Specialist® (SRES®), I guide clients through these important transitions with compassion, expertise, and a deep understanding of the South Bay market.

Finding a Senior Community That Fits Your Lifestyle

Many adults in their 60s and 70s hesitate at the thought of moving into a “senior” community. It’s normal to worry about losing independence or ending up in an environment that feels clinical.

But here’s the truth: today’s 55+ communities are evolving. Many offer resort-style amenities, social events, and walkable layouts. However, they still may not be the right fit for everyone.

My clients often want:

-

Homes with less maintenance but more personality.

-

Main-level living is designed with aging in place in mind.

-

Walkable, social neighborhoods with welcoming communities.

-

Space for pets, hobbies, and visiting grandkids.

These homes exist; you just need the right guidance to find them.

Should You Rent or Buy in Retirement?

Retirement brings new choices, including whether to rent or buy your next home. Renting can provide freedom, predictability, and access to amenities without the burden of maintenance. Buying, on the other hand, builds equity, stability, and long-term security.

Renting in Retirement

Pros:

Lower responsibility for upkeep.

Predictable monthly costs.

Freedom to travel and move easily.

Cons:

Rising rents and less long-term control.

Buying in Retirement

Pros:

Builds equity and security.

Ability to personalize and renovate.

May lower costs over time.

Cons:

Ongoing maintenance.

Less relocation flexibility.

As an SRES®, I help you compare these options with your personal goals in mind.

Loneliness and Connection in Later Life

Did you know loneliness is one of the biggest health risks as we age? More than one in three adults over 50 report feeling isolated. This can lead to depression, cognitive decline, and even increased health risks.

Connection matters. Small steps like joining a walking group, attending community events, or volunteering. It can make a real difference. Sometimes, moving to a more social neighborhood or closer to family opens new opportunities for engagement.

Choosing a home that encourages connection adds both years to your life and life to your years.

Multigenerational Homes: Growing Under One Roof

Multigenerational living is on the rise across the South Bay and beyond. Families are choosing homes that bring multiple generations together under one roof. Shared living can reduce expenses and create stronger bonds, but the right layout is essential.

Key features include:

-

Main-level suites for aging parents.

-

Separate entrances or private living spaces.

-

Accessibility features like no-step entries and walk-in showers.

-

Shared kitchens and dining areas built for connection.

-

Outdoor space for relaxation.

-

Ample storage to handle belongings from multiple households.

Every family has a different vision of what “home” looks like. As your South Bay SRES®, I help you find properties that balance comfort, independence, and togetherness.

About Me

I’m Malena Koki, a second-generation REALTOR® with over 16 years in the South Bay. As a Seniors Real Estate Specialist®, I specialize in guiding older adults, retirees, and families through transitions. From downsizing to finding pet-friendly senior communities to selecting multigenerational homes, I combine local expertise with genuine care.

Begin Your Next Chapter in the South Bay

Senior living doesn’t mean slowing down—it means living smarter. Whether you’re exploring senior communities, debating renting vs. buying, or considering multigenerational living, the South Bay has options designed for your next chapter.

Ready to find the right home for your lifestyle? Contact me today and let’s start the journey—on your terms.

🔗 Helpful Resources

Understanding Closing Costs in Redondo Beach: A Buyer and Seller’s Guide

Redondo Beach offers coastal living with unique costs to consider when buying or selling

When buying or selling a home in Redondo Beach, it’s easy to focus on price, location, and negotiations. However, one factor that often surprises both buyers and sellers is the closing cost. These are the expenses that finalize your real estate transaction, and understanding them is key to avoiding stress and planning wisely.

What Are Closing Costs?

Closing costs are the fees and expenses you pay at the end of a real estate transaction, on top of the purchase price (for buyers) or deducted from the sale proceeds (for sellers). They typically cover services like loan origination, escrow, title insurance, property taxes, and recording fees.

Closing costs cover the final steps of every Redondo Beach real estate transaction

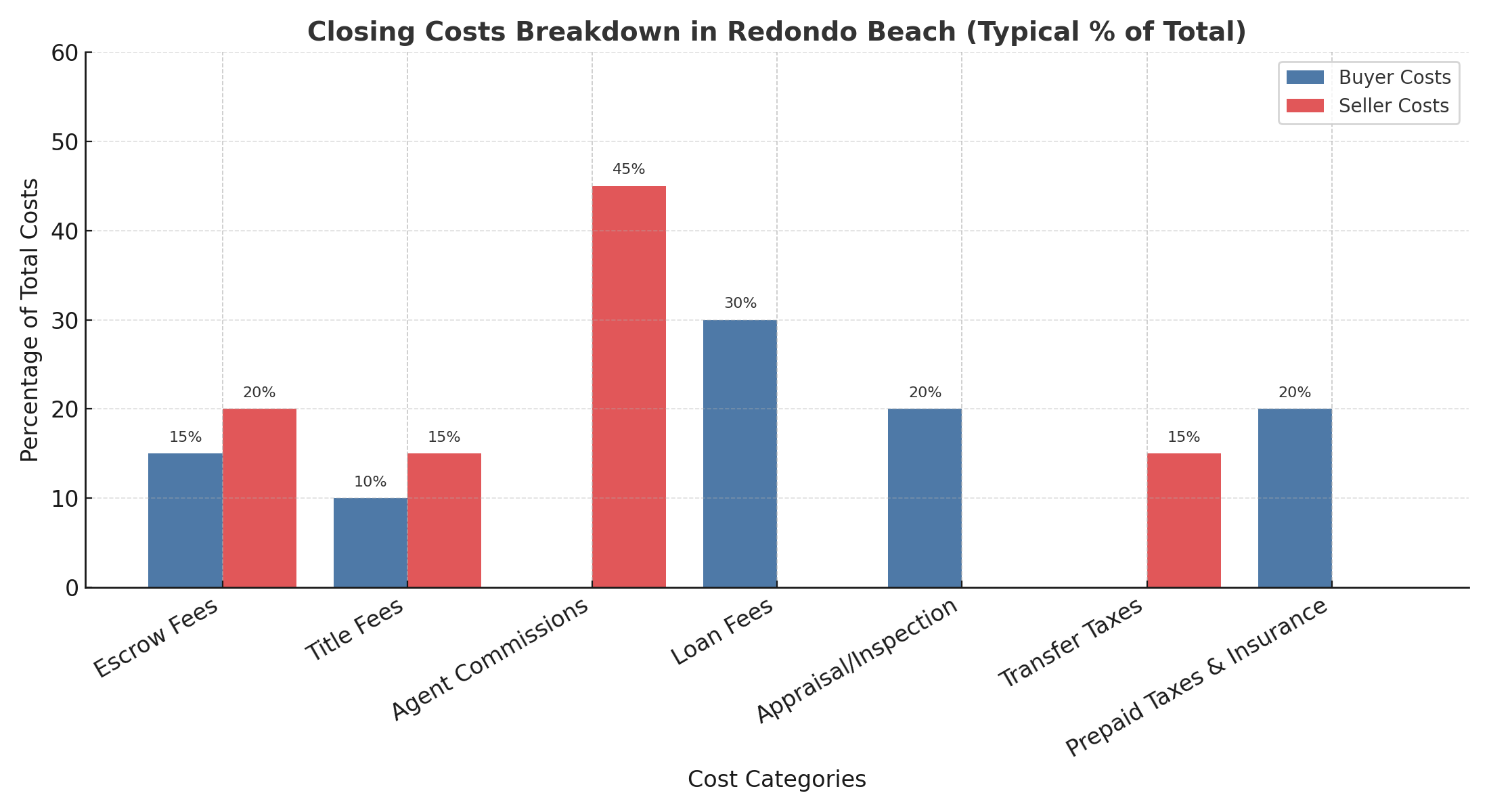

Typical Buyer Closing Costs in Redondo Beach

As a buyer, you can expect your closing costs to range between 2% and 5% of the home’s purchase price. For example, on a $1,000,000 Redondo Beach home, costs may be between $20,000 and $50,000.

Common Buyer Expenses:

-

Loan Origination Fees – Paid to your lender for processing your mortgage.

-

Appraisal and Inspection Fees – Covering professional assessments of the home.

-

Escrow Fees – Charged by the neutral third party who manages funds and paperwork.

-

Title Insurance – Protects against claims or disputes about property ownership.

-

Prepaid Taxes & Insurance – Property taxes and homeowner’s insurance are due at closing.

A young, happy couple is buying a new home and receiving the key from their real estate agent.

Typical Seller Closing Costs in Redondo Beach

Sellers usually pay more in closing costs, although many of these are tied directly to the sale proceeds. In Redondo Beach, sellers should budget around 6%–8% of the final sale price, with most of this being agent commissions.

Common Seller Expenses:

-

Agent Commissions – Typically 5%–6% of the sale price, split between the listing and buyer’s agents.

-

Escrow Fees – A portion of the escrow services cost.

-

Title Fees – Covering the transfer of title to the new owner.

-

Repairs or Credits – Negotiated with the buyer after inspections.

-

Transfer Taxes – Fees paid to the city or county for recording the transaction.

Sellers typically cover commissions, escrow fees, and title costs

Why Closing Costs Matter in Redondo Beach

Because Redondo Beach homes often sell in the $1M–$2M+ range, closing costs can be substantial. Buyers need to prepare cash reserves, while sellers should calculate net proceeds realistically. In competitive markets, sellers may even agree to cover some buyer costs to help finalize a deal.

Typical buyer vs. seller closing cost distribution in Redondo Beach real estate transactions

Tips to Prepare for Closing Costs

-

Ask for a Closing Disclosure Early – Buyers can review a detailed breakdown before signing.

-

Negotiate Smartly – In some cases, you can request a seller credit to offset costs.

-

Compare Lender Fees – Not all lenders charge the same origination or processing fees.

-

Work with a Local Expert – An experienced South Bay agent ensures no hidden surprises.

About Me: Your South Bay Real Estate Partner

I’m Malena Koki, a second-generation real estate agent with over 16 years of experience living and working in the South Bay. As part of Coldwell Banker Realty in Manhattan Beach, I’ve helped families, investors, and downsizers navigate the unique real estate opportunities that Redondo Beach offers.

Because I’ve lived in Los Angeles for more than 16 years with my husband, two children, and our three poodles, I understand both the lifestyle and financial aspects of buying or selling here. My background in investment property, global perspective from living in Japan and Europe, and concierge-level service allow me to guide clients seamlessly through every stage of their real estate journey.

Final Thoughts

Closing costs in Redondo Beach can feel overwhelming, but with the right preparation, they don’t have to be. Buyers should budget carefully, while sellers must calculate net proceeds to plan their next move. Because every transaction is unique, having an experienced local agent by your side can make all the difference.

✨ If you’re planning to buy or sell in Redondo Beach, I’d love to walk you through the process step by step. Contact me today for a personalized closing cost estimate tailored to your property.

🔗 Helpful Resources:

Navigating Every Generation: How Evolving Buyer-Seller Trends Are Shaping South Bay Real Estate

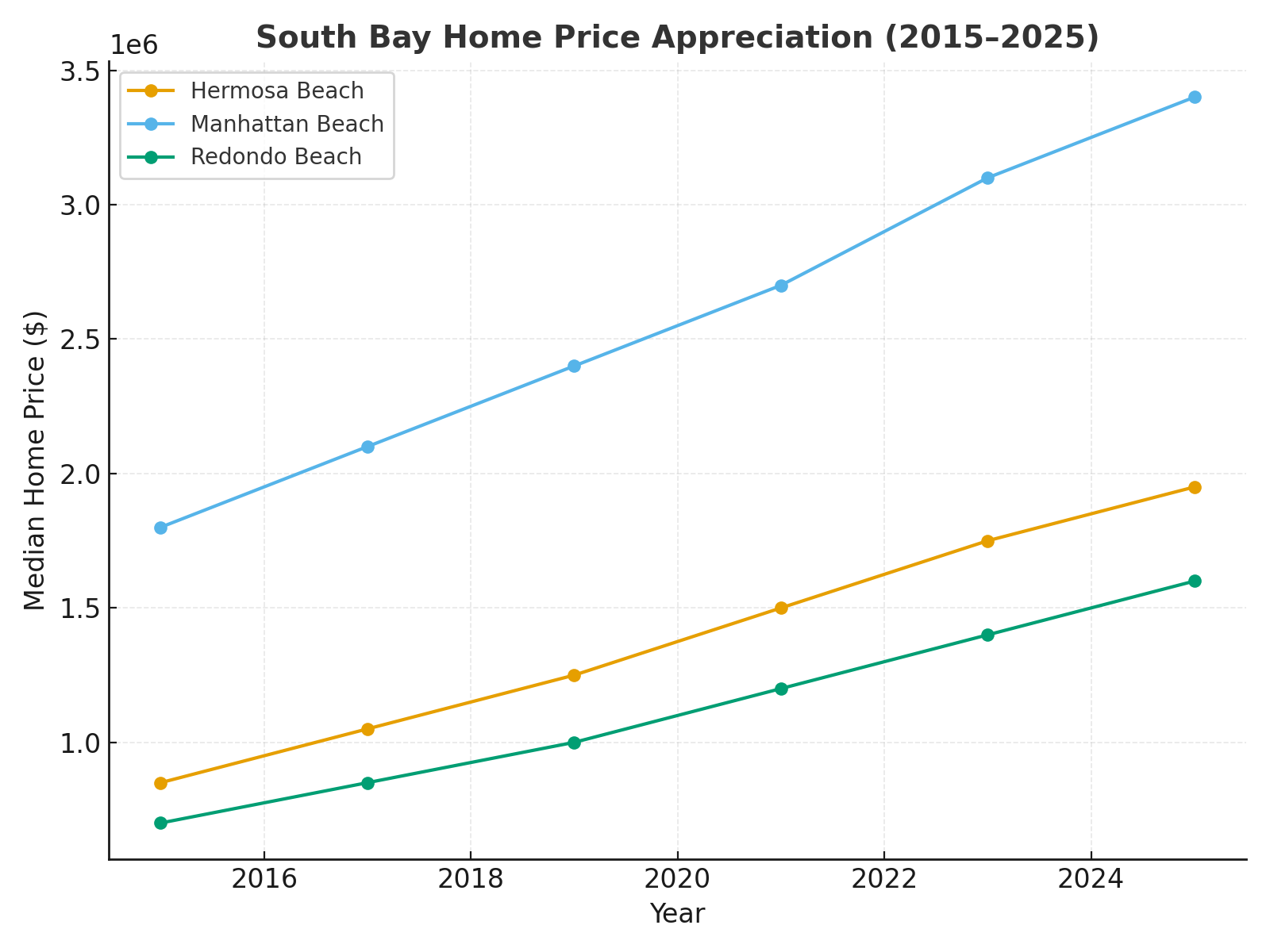

South Bay home values continue to show resilience and long-term appreciation

In today’s dynamic South Bay real estate market, staying ahead means understanding not just local trends but also how generational shifts fundamentally influence demand, pricing, and strategy. In this article, we’ll explore how insights from the National Association of REALTORS®’ “Home Buyer and Seller Generational Trends” report, combined with recent South Bay data, are reshaping the landscape—and how you can leverage these insights to succeed.

Generational Trends and Their Impact on South Bay Real Estate

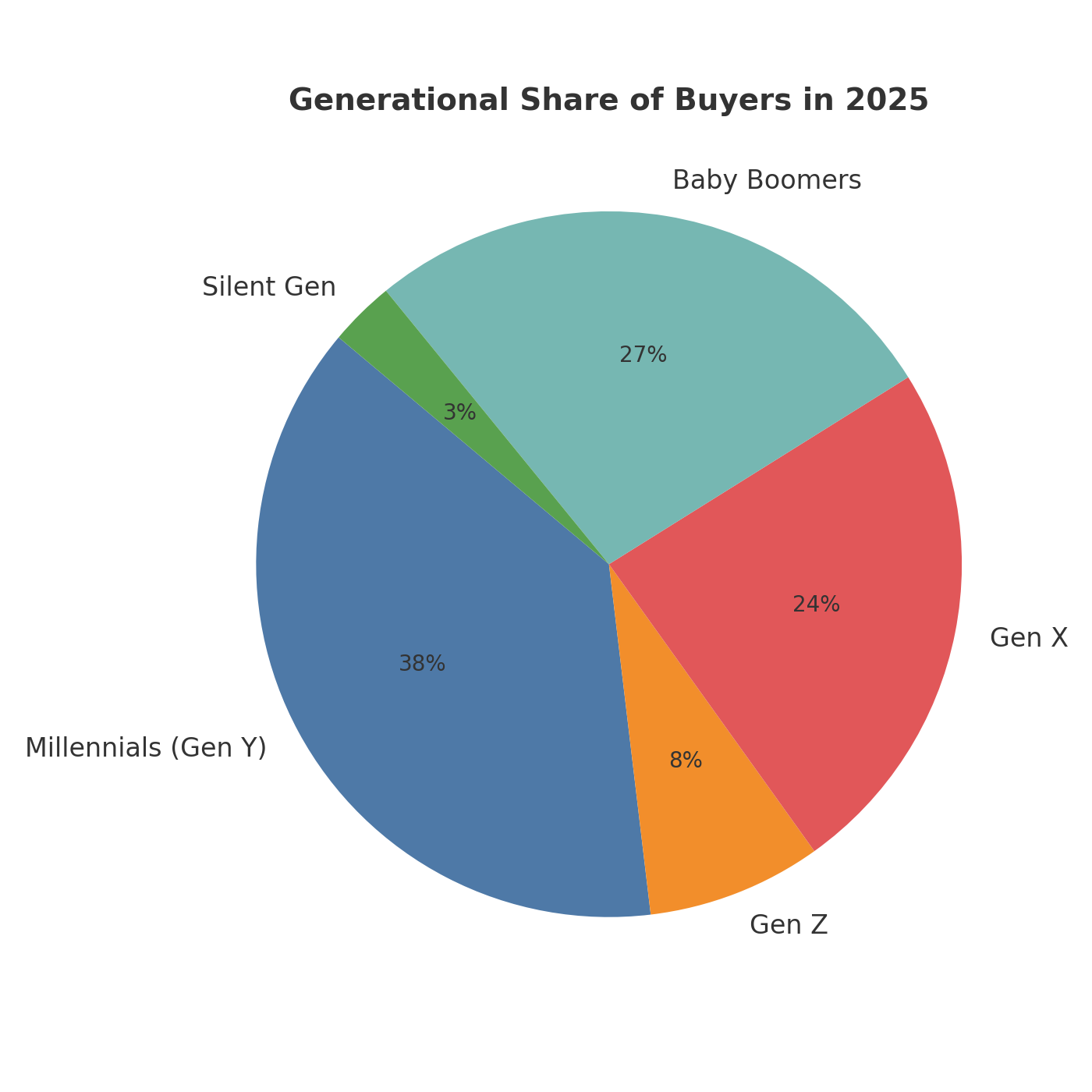

First and foremost, according to the National Association of REALTORS®, younger generations, namely Millennials and Gen Z, are increasingly entering the housing market. They come with a focus on walkability, lifestyle alignment, and long-term value. At the same time, Gen X and Baby Boomers are downsizing or relocating for lifestyle changes. This multi-generational interplay is especially relevant in the South Bay, a coastal region offering both vibrant communities and luxury beachfront living.

Learn more here: NAR Generational Trends Report

Because the South Bay comprises coveted neighborhoods, from Hermosa and Manhattan to Redondo and Palos Verdes, the mix of lifestyles these generations pursue is particularly impactful.

Median home prices in Hermosa Beach, Manhattan Beach, and Redondo Beach have steadily appreciated over the last decade. Confirming the South Bay’s strength as a long-term investment

Millennials now represent the largest share of South Bay buyers, while Baby Boomers remain strong participants, highlighting the importance of multigenerational strategies

Why It Matters: South Bay Market Insights

-

Price Resilience & Appreciation: Over the last decade, homes in the South Bay have appreciated by an estimated 95% to 115%. Depending on the neighborhood and property type, this coastal region proves that it remains a smart long-term investment.

-

Market Competitiveness: As of July 2025, the median home price in South Bay is around $1.3 million. With many properties receiving multiple offers and selling within 43 days, this highlights sustained demand.

-

Strategic Shifts for Buyers and Sellers: Although inventory has increased slightly, the South Bay remains somewhat competitive. Sellers must prioritize pricing and presentation, while buyers may enjoy more negotiating power, especially within condominiums or townhomes.

Connecting Generational Trends to the South Bay Advantage

-

Millennials & Gen Z

These generations seek lifestyle-rich environments, emphasizing access to transit, walkable neighborhoods, and recreation. South Bay offers all this: from beachfront access to upgraded infrastructure like the Metro C Line extending to Redondo Beach, making the area highly attractive.

-

Gen X & Baby Boomers

Many are downsizing or enjoying second-home luxury in scenic areas. They value discretion, proximity to amenities, and quality-of-life upgrades. The South Bay’s upscale neighborhoods, limited new inventory, and stable appreciation cater perfectly to these expectations.

-

Equity-Backed Buyers & Wealth Transfers

As equity builds, older generations are financing luxury moves or providing generational support to younger buyers. These funds reinforce demand, especially in South Bay’s premium markets.

In Summary: What It Means for You

Multiple generations are shaping demand in the South Bay. The market blends luxury appeal, lifestyle-driven choices, and strategic opportunities. Young families seek community. Affluent downsizers look for refined coastal living. Equity-backed buyers make calculated moves. Knowing who influences the market and how is essential to success.

Ready to buy or sell in the South Bay? Our team specializes in Manhattan Beach, Redondo Beach, Hermosa, and Palos Verdes. Reach out now for personalized guidance

Curb Appeal Missteps to Avoid , from a Real Estate Agent’s Point of View

Perfect location, stunning design, and that feeling you can’t explain… curb appeal at its best

Avoid These Common Curb Appeal Missteps — From a Real estate agent’s point of view

Living and working right here in the South Bay, I’ve seen firsthand how small exterior details can make or break a buyer’s first impression. As someone deeply rooted in our community and passionate about presenting homes at their best, I want to share six key curb appeal mistakes homeowners should avoid:

1. Overgrown or Unkempt Landscaping

A lush, well-maintained yard says “welcome home.” But overgrown trees, unruly bushes, or dead flower beds can instantly feel neglected House BeautifulSouthern Living. Think clean lines, seasonal pops of color, and trimmed hedges that frame—not hide—the house.

A quick lawn refresh can add thousands to your home’s value in the South Bay market

2. Bare or Sparse Yards

Conversely, a yard that looks forgotten. Minimal greenery and no visual interest can feel cold and characterless. I often recommend adding easy-care plants or a small tree to give life and dimension. Perfect for busy SoCal homeowners.

A dry yard can make buyers think twice. Let’s turn your South Bay curb appeal from parched to polished

3. Peeling Paint or Faded Exterior

Paint dulling or peeling is one of the clearest signs a home needs attention—and it lowers offers Architectural Digest. You don’t need a full repaint—focusing on the front door, trim, and shutters can breathe new life into a façade.

A little bit of paint on the trim can go a long way in boosting curb appeal and home value in the South Bay

4. Outdated House Numbers and Mailboxes

Struggling-to-read house numbers or rusted mailboxes not only look dated—they’re a practical problem for guests, deliveries, and prospective buyers. A sleek modern mailbox and crisp new numbers are affordable upgrades worth every penny.

Buyers notice the little things; replace that outdated mailbox for an instant refresh

5. Cracked Driveways or Walkways

A cracked, stained driveway can subconsciously signal deferred maintenance. Pressure washing cracks, addressing minor issues, or even offering a driveway credit can help close faster and at a better price.

First impressions start at the curb. Don’t let a cracked driveway send the wrong message

6. Political Signs or Over-Decorated Yards

While personalization is wonderful, flags, posters, or an overly themed yard can alienate nearly half the market Southern Living. When your home is on the market, neutral and classic beats personal every time.

When it comes to curb appeal, less is more. Too many garden decorations can distract buyers from your South Bay home’s best features

Why This Matters in the South Bay

In a community as vibrant and competitive as Los Angeles’s South Bay, curb appeal isn’t a “nice to have.” A fresh, inviting exterior can boost offers and shorten days on market by as much as 7–10%. From Manhattan Beach to Palos Verdes, buyers expect properties that feel cared for, and that begins long before they step inside.

My South Bay Strategy: Elevated & Attainable

As someone who’s helped dozens of neighbors sell fast and with premium results, here’s how I approach curb appeal with elegance and ease:

-

Scout before staging — I walk the entire exterior, noting peel, clutter, cracks, or dated features.

-

Curate quick wins — Replace hardware, power-wash surfaces, update numbers/mailbox, all within budget.

-

Bring in seasonal pops — Local blooms, tasteful potted plants, and mulch that complements the home’s palette.

-

Strategic paint refresh — A crisp front door (or trim) color goes a long way, often under $500.

-

Hand-off to trusted pros — I leverage my vetted network, from gardeners to painters, to craft an effortless transformation.

A pop of color from local flowers can instantly brighten your curb appeal

The Result?

A South Bay home that stops buyers in their tracks, evokes that “soft sigh” of comfort, and invites them in before they even ring the bell. That’s the blend of approachable warmth and elevated presentation I bring to every listing.

From the moment you walk in, this South Bay gem says it all: “Welcome home”

Want Selling Results That Move at the Speed of L.A.?

If you’re thinking of selling, or just curious how curb appeal could elevate your property’s value, even if you’re not ready to list reach out. I’m always accessible, grounded in community, and ready to guide you with style and savvy—Malena Koki, your South Bay real estate partner.

Is the Los Angeles Market Finally Easing? How South Bay Buyers Can Benefit in 2025

What Slower Single-Family Starts Mean for South Bay Real Estate in 2025

April’s report from the National Association of Home Builders (NAHB) reveals a mixed message. New construction is growing, but only in some segments. If you’re buying, selling, or investing in the South Bay or Greater Los Angeles, here’s what this means for you.

Multifamily builds rose, but single-family construction dropped

Housing starts rose 1.6% in April, reaching an annual rate of 1.361 million units. However, most of that growth came from multifamily housing, like apartment buildings and condos.

Meanwhile, single-family home starts fell 2.1%, dropping to 927,000 units. This matters because single-family homes remain the most desired option in suburban and coastal neighborhoods like Manhattan Beach, Redondo Beach, Hermosa Beach, and Palos Verdes.

Why the shift? Developers are focusing on higher-density options. This trend reflects affordability challenges, high land prices, and space limitations, especially in popular Southern California markets.

Building Permits Are Down—And That’s a Warning Sign

In April, building permits dropped 4.7%. This is important because permits are a forward-looking indicator. Fewer permits today mean fewer homes tomorrow.

This decline could lead to even tighter inventory in already competitive areas like the South Bay. If demand holds steady or increases, home prices could feel more upward pressure.

Other Market Pressures: Interest Rates, Fires, and Tariffs

The market isn’t just reacting to construction data. Several external factors are also creating uncertainty:

-

Interest rates remain elevated, keeping monthly payments high and affecting buyer affordability.

-

Recent wildfires across Southern California have disrupted construction timelines and increased insurance premiums.

-

Ongoing tariff concerns and supply chain issues could push construction costs even higher. That adds risk for builders and impacts future housing availability.

What to Expect Going Forward in South Bay Real Estate

1. Inventory Is Slowly Rising

-

We’re seeing an increase in homes for sale across South Bay cities like Manhattan Beach, Redondo Beach, Torrance, and Palos Verdes.

-

While inventory is still limited compared to pre-pandemic levels, this uptick gives buyers more choices.

2. Homes Are Taking Longer to Sell

-

Days on market are creeping up.

-

This shift is subtle but important—sellers may need to be more flexible, especially if their home isn’t priced right or move-in ready.

3. More Room for Negotiation

-

For buyers, this presents a unique window of opportunity.

-

You may be able to negotiate better terms, ask for repairs or credits, or even avoid bidding wars.

-

Pre-approval and a smart offer strategy still matter, but the dynamic is shifting slightly in your favor.

4. Prices Are Holding, But Momentum Is Easing

-

High interest rates continue to keep prices stable, but not surging.

-

The fear of missing out (FOMO) has cooled, and cautious buyers are starting to re-enter the market with more leverage.

5. Sellers Must Adjust Their Strategy

-

Proper pricing and strong presentation are more important than ever.

-

Homes that stand out—either through design, location, or value—will still move quickly.

-

Overpriced listings, however, may sit longer or require price reductions.

6. Still Watching: Interest Rates, Construction Costs, and Insurance

-

Higher borrowing costs and recent fires continue to affect timelines and buyer confidence.

-

Tariffs and global supply issues could push construction prices up again, making resale homes even more appealing in the near future.

Local Insight: South Bay Resale Market Still Strong

Even with higher borrowing costs, home prices in the South Bay remain resilient. Limited single-family supply is keeping values steady, especially in sought-after coastal communities.

Because there are fewer new homes, resale listings are more important than ever. That’s why I stay focused on uncovering off-market opportunities and prepping listings that shine.

Let’s Talk Strategy

The market is shifting. Whether you’re planning to buy, sell, or invest, it helps to have someone who understands how construction trends, economic factors, and local dynamics affect your next move.

📩 Ready to talk real estate in the South Bay or Greater Los Angeles? Let’s connect.

Sources: Single-Family Starts Down on Economic and Tariff Uncertainty (NAHB) , Building Permits by State and Metro Area (NAHB)

Why Now Is Still a Great Time to Invest in L.A.’s South Bay Real Estate

Why Now Is Still a Great Time to Invest in L.A.’s South Bay Real Estate

Let’s be honest: No one loves higher interest rates. But waiting on the “perfect” rate might mean missing out on a good investment and the dream of ownership. Buying in South Bay can still be a smart move. Home prices keep rising, the lifestyle is unmatched, and real estate offers long-term benefits. Let’s look at why buying now might be better than waiting.

Manhattan Beach, CA

1. South Bay Real Estate Is Still Appreciating

South Bay isn’t just a beautiful place to live – it’s a smart place to invest. From coastal cities like Manhattan Beach and Redondo to family-friendly Torrance or up-and-coming areas like Lawndale, home values have consistently shown strong long-term growth. Even with fluctuations, the trend in this region is upward.

• Inventory remains limited.

• Demand remains high, driven by lifestyle, good schools, and proximity to L.A. and the coast.

• Well-located homes continue to see multiple offers, especially when priced well.

Waiting for rates to drop may leave you paying more for the same home later.

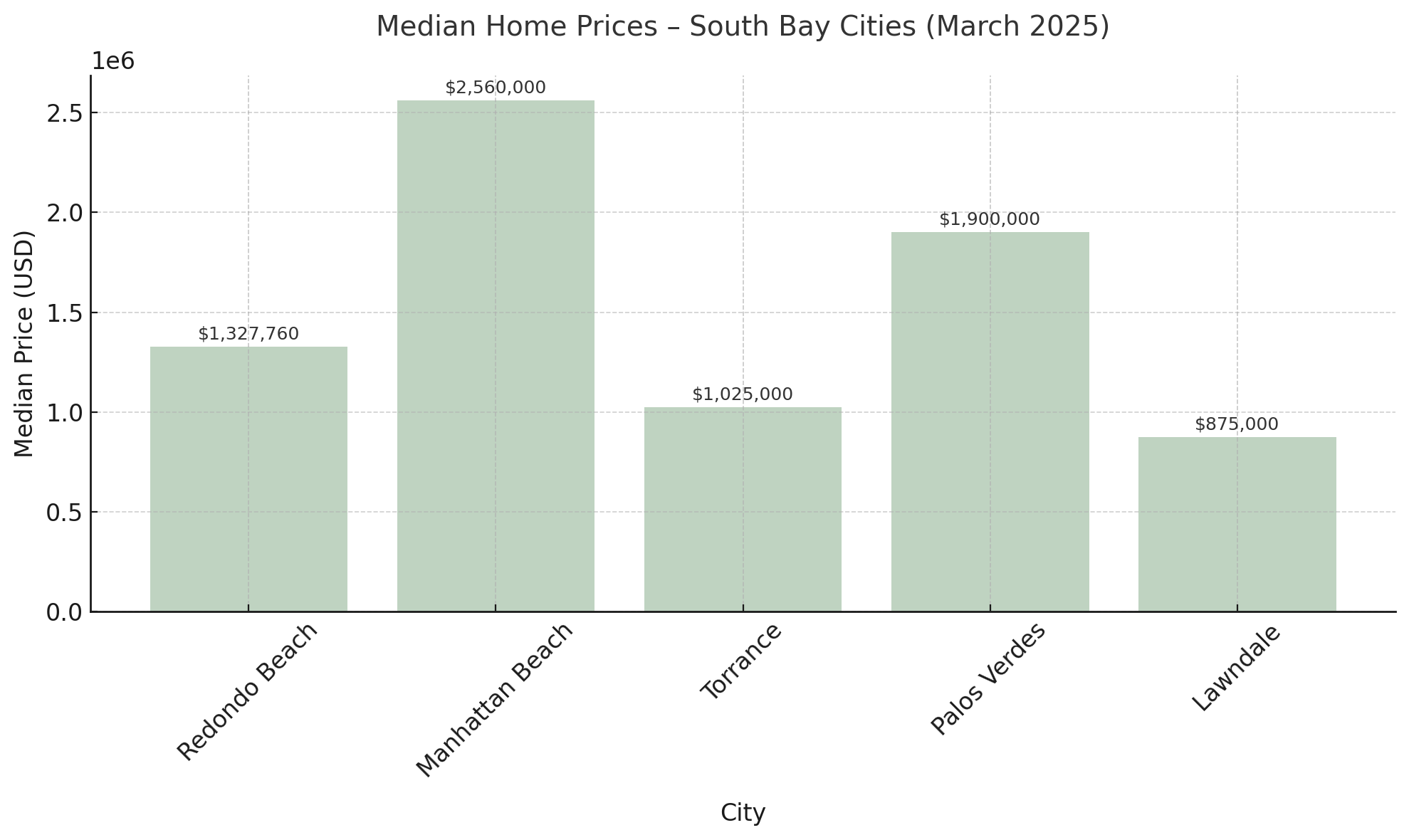

In March 2025, the median sold price in South Bay topped $1.3M, marking a 6.4% increase year‑over‑year, even as other parts of Southern California saw only modest gains. Across the broader South Bay Cities (including Manhattan Beach, Torrance, Rancho Palos Verdes), the median surged to $1.8M, up 9.7% from February 2024.

South Bay home values continue to climb, and that long‑term appreciation can more than offset today’s higher borrowing costs.

The data shown reflects estimated median home prices as of March 2025 for select South Bay cities. Prices are subject to change based on market conditions, local inventory, and interest rates. This chart is intended for informational purposes only and should not be taken as financial advice. Sources: • California Association of Realtors (CAR) • CoreLogic Housing Market Report • California Regional Multiple Listing Service (CRMLS) • Internal research based on South Bay MLS data

2. Rates Aren’t Headlines-They’re Just Numbers

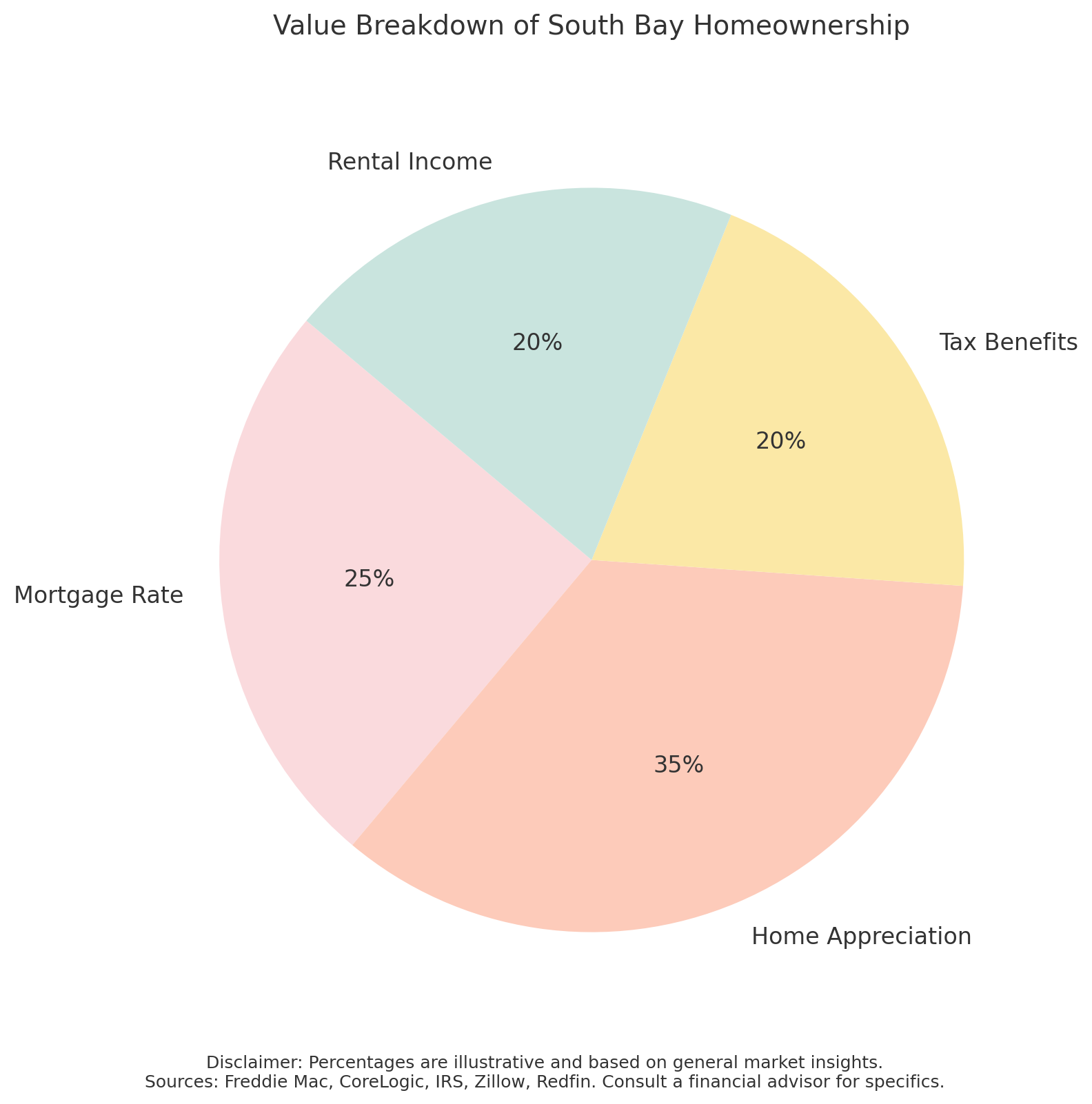

Yes, the average 30‑year fixed mortgage rate recently reached 6.81% (week ending April 11, 2025), its highest in two months. But national data from Freddie Mac pegs the same rate closer to 6.62%, down from 6.88% a year ago. In either scenario, locking in today’s rate protects you against future hikes, and you can always refinance later if rates drop. Yes, rates impact your monthly payment, but here’s what else matters:

• Home Appreciation: Your property is likely to gain value over time, building your wealth.

• Tax Benefits: Mortgage interest and property taxes may be deductible.

• Rental Income Potential: In the South Bay, rental demand is strong. If you’re investing, higher rates can often be offset by rental cash flow.

And I will say it again, a little truth most people forget:

You can refinance the rate.

You can’t rewind time and buy at yesterday’s price.

3. Real Estate Is a Hedge Against Inflation

When consumer prices rise, tangible assets like property often keep pace or even outstrip inflation. A fixed‑rate mortgage gives you predictable monthly payments, while the market value of your South Bay home is likely to continue climbing. Over the last decade, L.A. County housing prices have nearly doubled, despite inflation averaging 2-3% annually. Meanwhile, U.S. home‑price indexes have risen in lockstep with or ahead of CPI each year.

4. You Can’t Time the Market-But You Can Time Your Plan

Attempts to “wait for rates to drop” often backfire. Financial markets move unpredictably: last week’s rate retreat may reverse this week. History shows that missing even a few months of appreciation can cost more than a slightly higher rate. Experts agree that home‑price cycles last years, while rate cycles can be short‑lived. A long‑term hold (whether you live in the home or rent it out) lets you ride out both rate and price swings.

South Bay Homeownership

Beyond Dollars & Cents: Lifestyle and Security

• A desirable lifestyle market with long-term equity growth

• Tight supply that helps protect home values

• Strong buyer interest, even in a higher rate environment

All told, you gain more than shelter; you gain stability and peace of mind in uncertain times.

Final Thought: Buy for the Long Game

If you’re ready to explore opportunities in South Bay-whether as a homeowner or investor-let’s talk strategy. Even if your ideal rate hasn’t arrived, your ideal home may already be on the market.

Contact me today for a personalized South Bay market update.

Don’t let “rate regret” keep you from building equity. No one likes the fomo feeling!

Real estate is a long game, and South Bay is a strong board to play on.

If you’re planning to hold the property, live in it, or rent it for a few years or more, today’s rate isn’t a deal-breaker – it’s just a starting point. The equity you build, the appreciation you gain, and the stability you secure all outweigh the rate that may feel less than ideal right now.

The wonderful South Bay of L.A.

Sources: Business Insider, South Bay Housing Market Report March 2025, Reuters News, Lendingtree, AP News, FRED.

How volatile stock market and tariffs may affect the real estate market?

How Tariffs and a Wobbly Stock Market Could Shake Up Real Estate

Let’s talk about what everyone’s whispering (or panicking) about—tariffs, a rollercoaster stock market, and how all this could mess with (or maybe help?) the real estate market.

In early April 2025, the U.S. imposed some hefty new tariffs on imports from various countries. The goal? Support American industries. The result? Wall Street had a mini meltdown, and now everyone’s watching how this all might impact housing.

The Stock Market = Jumpy

Real Estate = Curious

The stock market didn’t take the news well. On April 3rd, the Dow dropped a jaw-dropping 1,679 points—the biggest single-day fall since 2020. Not to be left out, the S&P 500 and Nasdaq also tumbled. Investors, naturally, are nervous about where this all leads.

Meanwhile, the real estate world is standing by, saying, “Okay… how does this affect us?”

Let’s break it down:

1. Construction Costs Are Climbing

So, here’s the deal: New tariffs on imported building materials like steel, aluminum, and even lumber are shaking up construction costs across the country. But in Los Angeles, the impact hits a little harder.

Why? Because we’re already dealing with limited space, high demand, and some of the priciest building regulations in the country. Now add on an average $9,200 increase per new home (according to the National Association of Home Builders), and you’ve got a recipe for… well, even higher home prices.

That extra cost doesn’t just magically disappear. It usually gets passed on to the buyer. So, whether it’s a sleek new development in Downtown LA, a townhome in Culver City, or a modern build in the Valley, expect price tags to keep climbing.

And if you’re thinking, “Well, I’ll just wait for more homes to pop up,” here’s the kicker: Builders may actually slow down new projects because of these added costs. Less inventory + high demand = more competition (and more over-asking bids).

Building in L.A. Just Got Pricier, And That’s a Problem After the Fires

Many communities in and around LA, especially in areas like Malibu, Topanga, and parts of the Valley, are still in various stages of rebuilding. These tariff-driven price hikes are a major setback for homeowners trying to recover and for developers trying to rebuild responsibly.

The demand for fire-resilient construction is rising, but so are material prices. That makes it harder and more expensive to build. But what the market is looking for are homes that are safer, smarter, insurable, and up to code.

Less building, higher prices, and limited supply? Yep, that means more competition for existing homes and even steeper prices in new developments.

2. Real Estate as a Safe Haven?

Here’s the upside: When the stock market gets shaky, real estate starts to look like the calm in the storm. Investors are already shifting funds from stocks into homes.

There has been a resurgence in investment lending within the housing sector, with annual growth reaching its fastest pace since 2022. This trend suggests that residential property is becoming an attractive option for those seeking refuge from the unpredictable stock market.

Why? Bricks and mortar feel a lot more stable than stocks bouncing up and down like a bouncy house. In the long term, real estate always tends to be more stable than stocks.

3. Could Mortgage Rates Drop?

Yes, maybe! We can’t predict the future. But historically, when markets panic, investors flock to safer places like U.S. Treasury bonds. This increased demand can drive down yields, potentially resulting in lower mortgage rates. So, even with rising home prices, lower rates could help buyers afford more (or at least stay in the game). It’s like one hand gives while the other takes away.

Some experts believe that declining mortgage rates could enhance housing affordability, partially offsetting the impact of higher construction costs.

4. Commercial Real Estate? Feeling the Pinch.

The tariffs have raised concerns about a potential slowdown in international trade, which could affect demand for commercial properties, particularly warehouses and distribution centers. Warehouses and distribution centers might be in for a bumpy ride. If trade slows, companies won’t need as much storage space. Big names like Prologis are already seeing their stock slip. So, if you’re in the commercial space, it’s time to keep a close eye on global trade trends.

What About Buyers?

Tariffs could also lead to higher prices on everyday goods. When groceries, gas, and gadgets get more expensive, people naturally spend less. Especially on big-ticket items like homes. The National Retail Federation is already predicting a slowdown in consumer spending for 2025. Buyers may just hit “pause” until the dust settles.

So, will people still buy homes? Yes! But maybe more cautiously. Some will jump in to grab low mortgage rates. Others will wait out the storm. Either way, real estate isn’t crashing—but it’s definitely adjusting.

Impact on the Housing Market

The housing market is experiencing mixed signals amid these economic shifts. On one hand, mortgage rates have slightly declined due to market volatility, potentially making home loans more affordable. Additionally, housing inventory has increased, providing buyers with more options and potentially leading to more favorable pricing.

Conclusion

The implementation of broad tariffs by the U.S. government has introduced significant uncertainty into financial markets and the broader economy. While the real estate sector may experience both positive and negative effects, stakeholders should closely monitor ongoing developments. Potential increases in construction costs and shifts in investment strategies underscore the importance of staying informed and adaptable in this evolving landscape.

While certain factors, such as lower mortgage rates and increased housing inventory, may encourage home purchases, the overall economic uncertainty stemming from recent tariff implementations and stock market volatility is likely to make consumers more cautious. This caution could lead to a slowdown in major expenditures, including real estate transactions, as individuals await a more stable economic environment.

Bottom line: If you’re in the market (buying, selling, or investing), stay informed, stay flexible, and maybe stock up on popcorn. This show isn’t over yet.

Want help navigating the market in these wild times? Let’s chat—I’m happy to break it down with you.

Tax Season Is Coming—Let’s Keep More of Your Money!

Real Estate Investment

Let’s be real-no one enjoys tax season. Watching a big chunk of your hard-earned money disappear? Painful. But what if I told you real estate investing could help you legally pay less in taxes and build long-term wealth at the same time?

Yep, smart real estate investors know how to use tax benefits to their advantage, and you can too. Whether you own a rental property, are thinking about investing, or already have a growing portfolio, understanding these tax perks could mean more money in your pocket and less going to Uncle Sam. Be sure to always consult with your CPA before making any financial decisions. This information is for educational purposes only.

So grab a coffee (or a glass of wine 🍷-no judgment), and let’s break down four major tax benefits of real estate investing that could change your financial future.

1. Tax Deductions – AKA, Write-Off Heaven

When you own investment properties, a ton of expenses can be deducted from your taxable income, meaning you pay less in taxes.

Think about it: If you had to spend money on these things anyway, why not get a tax break for it?

What kind of things, you may wonder? Well, here are some examples:

-

-

Mortgage interest

-

Property taxes

-

Insurance

-

Maintenance & repairs

-

Property management fees

-

Legal & accounting costs and more!

-

Not too bad, right? Let’s continue reading (sipping too 😀 )

2. Depreciation – A Hidden Superpower for Investors

Real estate naturally loses value over time (at least on paper). The IRS lets you deduct that “loss” every year through depreciation. Even if your property is increasing in value.

📌 Residential properties depreciate over 27.5 years

📌 Commercial properties depreciate over 39 years

Let’s say you own a $500,000 rental property (not including land). Divide that by 27.5 years, and boom- $ 18,181 in annual deductions you can take, lowering your taxable income. That’s free tax savings for simply owning property!

3. Capital Gains Tax – Play It Smart When You Sell

Selling real estate at a profit? Congrats! But before you celebrate, let’s talk about capital gains tax.

- Short-term capital gains (owning for less than a year) = higher taxes (treated like regular income).

- Long-term capital gains (owning for a year or more) = lower taxes (0%, 15%, or 20% tax rate).

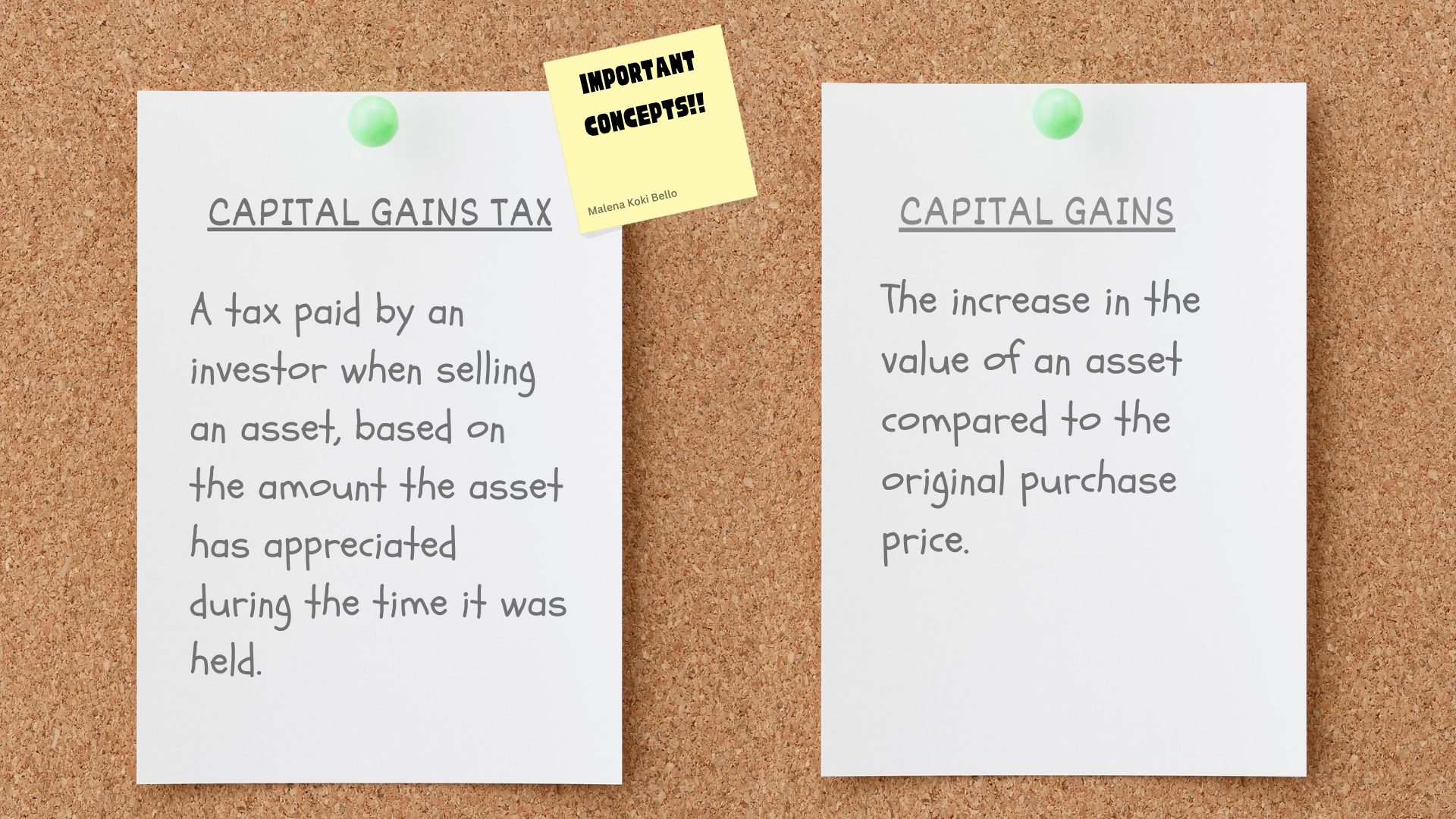

Capital Gain vs Capital Gain Taxes

👉 Pro tip: Hold onto your property at least a year before selling. It could save you thousands in taxes!

4. The 1031 Exchange – The Ultimate Tax Hack

Want to sell a property but avoid paying capital gains taxes? The 1031 exchange lets you reinvest your profits into another property (of equal or greater value) and defer those taxes.

1031 Exchange

Translation: Keep upgrading your real estate portfolio without getting taxed on every sale. Use it enough times, and you could keep rolling your wealth forward tax-free for decades.

Use Your Tax Return Strategically

If you’re expecting a tax refund this year, consider using it as a stepping stone toward your real estate goals. Instead of spending it on short-term purchases, you could apply it toward a down payment, closing costs, or even invest in home improvements that increase your property’s value. This is also a great time to consult with your CPA and a real estate advisor to align your refund with your long-term financial strategy—whether you’re buying your first home, expanding your portfolio, or planning for retirement. Real estate can turn that refund into something that keeps paying you back over time.

If you want to learn how to maximize these tax benefits for yourself, let’s talk! I’d love to help you strategize and find the best real estate investment opportunities. I’m based in Manhattan Beach, CA, part of the beautiful South Bay.

📩 DM me or call me today, let’s make sure your money is working for YOU!

Looking to Sell Your Home? Five Essential Tips for Homeowners

Looking to Sell Your Home? Five Essential Tips for Homeowners

In the competitive South Bay real estate market, every detail matters. From pricing to presentation, small decisions can impact your results. Whether you’re selling, renting, or flipping a home, strategy is key.

Today’s buyers start online, expect transparency, and value well-maintained spaces. They also respond to honest communication and flexible terms. Therefore, understanding current trends and buyer behavior gives you a strong advantage.

In coastal communities like Manhattan Beach, Hermosa Beach, and Redondo Beach, expectations are high.

But with the right approach, you can stand out and succeed.

1. Set the Right Price: The First Step to Success

One of the most common mistakes homeowners make is pricing their home too high off-market.

This often happens when emotions or guesswork drive the decision instead of market data. As a result, the property may sit for months without strong buyer interest. Over time, the listing can become stale and lose momentum. Or worse, it may never attract serious offers, leading to price drops and frustration.

The reality, buyers often skip overpriced homes in favor of better-valued options. Even if they visit, they may not see it as worth negotiating. This delay can weaken your position and reduce your final sale price. On the other hand, pricing it right from the start creates excitement and urgency. Well-priced homes tend to sell faster and attract multiple offers. That means a better return and less stress for you as the seller.

Therefore, when is time to sell your home it’s essential to work with an expert who understands local market trends. With the right strategy, you avoid costly delays and reach serious buyers quickly.

Tip: Research the market in your area and adjust the price based on current conditions. And a well-priced property is much more likely to rent or sell quickly.

2. Presentation: Maintenance and Improvements Increase Value

First impressions matter—especially in real estate.

A home’s condition can make or break a deal instantly. Buyers and renters often decide within the first few minutes. If the property looks clean, updated, and well-maintained, it stands out right away. As a result, it’s more likely to rent or sell your home quickly.

Well-presented homes attract more showings and stronger offers. In contrast, neglected properties sit longer and draw less interest. Therefore, taking time to prepare your home is a smart move. Simple updates, repairs, and staging can make a big impact. When done right, these efforts often lead to a faster, higher-value transaction.

Tip: Invest in regular maintenance. Small improvements, such as a new coat of paint or minor repairs, can significantly increase the attractiveness of your property.

3. Transparency: Clarity of Terms from the Start

Prospective buyers want to work with honest, trustworthy people.

Buyers value clear communication and straightforward expectations. From the start, transparency builds confidence and strengthens relationships. When you’re upfront about the terms of the sale, you avoid confusion later.

As a result, buyers feel more comfortable moving forward. Clear terms also reduce the risk of misunderstandings or delays. In contrast, vague or hidden details can cause hesitation or even derail a deal. Therefore, it’s essential to communicate everything clearly and early in the process.

Trust helps deals close faster and with fewer surprises. And in real estate, trust is everything.

Tip: Explain all terms from the first contact. This includes details about applicable limitations or regulations.

4. Digital Marketing: Make your Property Visible Online

Today, most buyers begin their home search online.

Buyers browse listings, photos, and reviews before reaching out. As a result, your digital presence matters more than ever. A clean, professional online listing builds immediate interest. High-quality photos and accurate details keep buyers engaged.

In contrast, poor presentation can drive them away quickly. Therefore, managing your digital presence is key to attracting the right clients.

From social media to listing platforms, every detail counts. Consistent branding and clear messaging help build trust from the start. When done well, your online presence becomes your strongest marketing tool. And that means more eyes, more offers, and better results.

Tip: Publish on major real estate portals and use tools like Google Ads or social media to increase your property’s visibility. And don’t forget to include attractive photos!

5. Flexibility: Maintain Openness in Negotiations

Sometimes, flexibility in negotiations can lead to better results.

Small adjustments often make a big difference. Being open to discussion shows you’re willing to work with potential tenants. For example, slightly lowering the price can attract more qualified applicants.

Allowing specific accommodations may also make your property stand out. As a result, you increase your chances of closing faster. In contrast, strict terms can limit your options and slow down the process. Therefore, a little give-and-take can go a long way.

Tip: Listen to offers from interested parties and be willing to negotiate certain aspects without compromising your main objectives.

Conclusion

Applying these lessons will maximize your chances of success in selling your property. As a real estate professional, I am committed to helping you achieve this with proven strategies and a personalized approach. Are you ready to put these tips into practice? Contact me and find out how I can help you achieve your goals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link